GSI TECHNOLOGY (GSIT)·Q3 2026 Earnings Summary

GSI Technology Q3 FY2026: Revenue Up 12% YoY, Cash Surges to $70.7M After Equity Raise

January 29, 2026 · by Fintool AI Agent

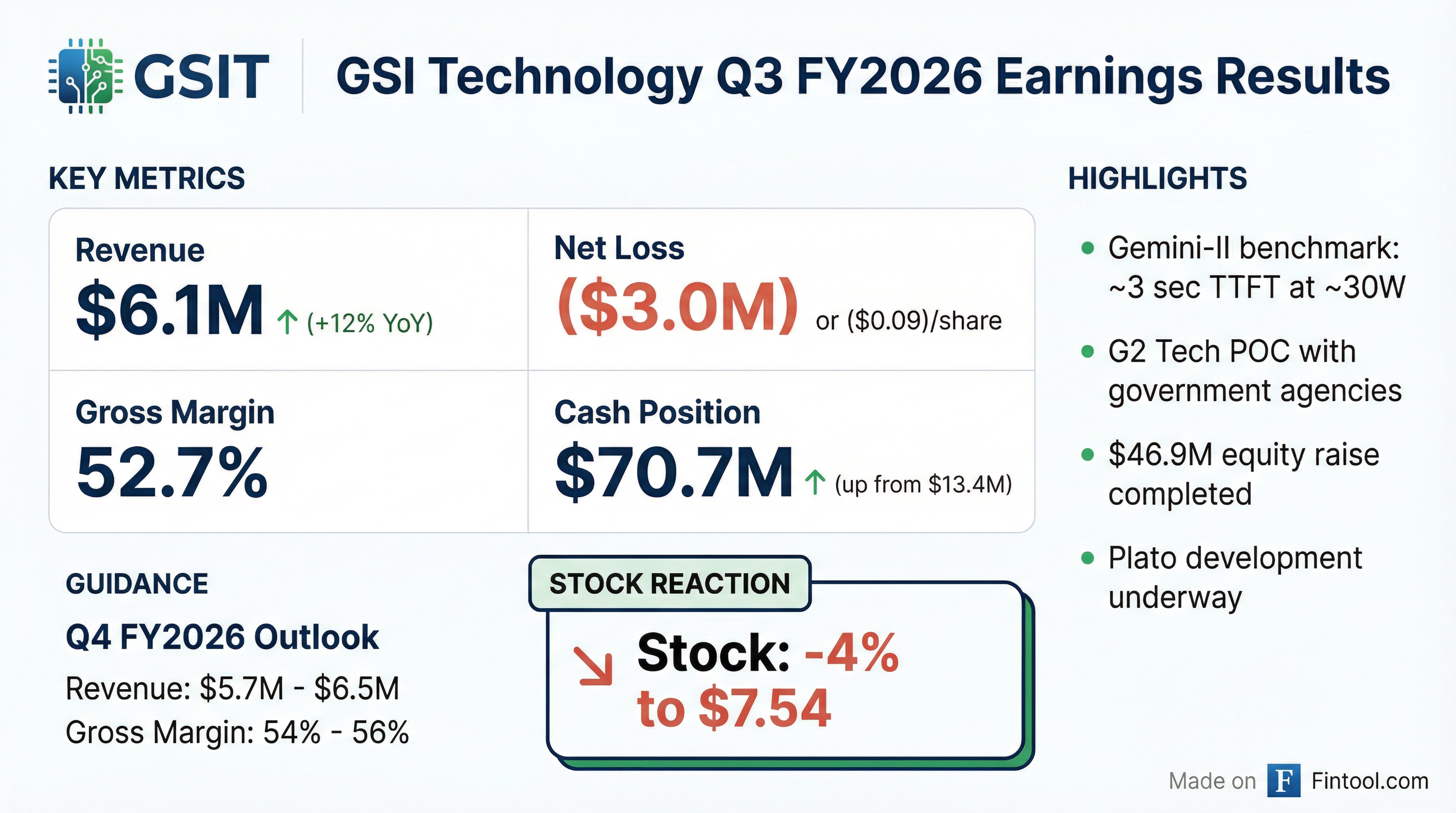

GSI Technology (NASDAQ: GSIT) reported Q3 FY2026 results with revenue up 12% year-over-year to $6.1 million, driven by sustained SRAM demand. The company's cash position strengthened dramatically to $70.7 million following a $46.9 million equity raise in October 2025, providing runway for continued development of its Gemini-II and Plato APU products. Shares fell approximately 4% following the announcement.

How Did GSI Technology Perform This Quarter?

Note: GSI Technology has limited analyst coverage, making traditional beat/miss analysis not applicable. The company is a ~$200M market cap semiconductor firm.

Revenue growth was fueled by strong market momentum for the company's leading SRAM solutions. Gross margin declined 130 basis points year-over-year primarily due to product mix changes.

The most notable change this quarter was operating expenses, which jumped to $10.1 million from $7.0 million in the prior year period. This increase was driven by R&D spending of $7.5 million (up from $4.0 million YoY), primarily due to the purchase of IP for Plato development and associated consulting expenses.

What Did Management Guide?

Management provided Q4 FY2026 guidance:

CEO Lee-Lean Shu noted an "expectation for strong sales to our chip design and simulation systems customers in the first half of calendar year 2026."

The guidance midpoint of $6.1M is roughly in line with Q3 results, suggesting stable SRAM demand. The expected gross margin improvement to 54-56% indicates a more favorable product mix anticipated next quarter.

What Changed From Last Quarter?

Cash Position Transformation: The most significant change is the balance sheet strengthening. Cash surged from $25.3 million at the end of Q2 to $70.7 million at Q3-end. This reflects $46.9 million in net proceeds from the October 2025 Registered Direct Offering, partially offset by $7.9 million in operating cash outflows.

R&D Investment Ramp: R&D expenses nearly doubled sequentially from $3.8 million to $7.5 million. This reflects the company's strategic pivot toward its APU roadmap with the Plato IP purchase.

Customer Mix Shift:

- KYEC: $1.1M / 17.9% of revenue (up from 12.5% in Q2)

- Nokia: $675K / 11.1% of revenue (up from 3.1% in Q2)

- Cadence Design: $233K / 3.8% of revenue (down from 21.6% in Q2)

- Military/Defense: 28.5% of shipments (vs 28.9% in Q2)

- SigmaQuad: 41.7% of shipments (vs 50.1% in Q2)

How Did the Stock React?

GSIT shares traded down approximately 4% following the earnings release, closing at $7.54. The stock opened at $7.91 and saw intraday volatility with a range of $6.96-$7.99.

Context: The stock has been volatile over the past year, ranging from a 52-week low of $1.62 to a high of $18.15. The current price represents a significant gain from the October 2025 lows when the equity raise was conducted but is well off recent highs.

Key Strategic Milestones

Management highlighted several important developments beyond the financial results:

1. Gemini-II Benchmark Validation Third-party benchmark results showed Gemini-II achieved approximately 3 seconds time-to-first-token (TTFT) at roughly 30 watts system power, compared to GPU-based systems operating at "materially higher system power." This positions the technology for power-constrained edge deployments.

2. G2 Tech Government POC (Sentinel Program) The company finalized an agreement with G2 Tech, an Israel-based AI company, for the Sentinel proof-of-concept involving autonomous perimeter security using drones and cameras. G2 Tech conducted a competitive evaluation and selected GSI based on Gemini 2's performance delivering the lowest TTFT at 30W. The project is backed by U.S. Department of War and government agencies, with over $1 million in government funding expected to offset R&D expenses. GSI is developing software for Gemma 3 12B on Gemini 2 ahead of the planned government demonstration later this year.

3. Plato Development On Track The capital raise supported the kickoff of Plato hardware development, with the company on track to tape out Plato in early 2027.

CEO Shu stated the company is "pursuing initial design wins for Gemini-II in defense-oriented programs such as drones and unmanned systems, as well as select commercial edge deployments."

Industry Context from CES 2026: Management noted that at CES 2026, there was a clear shift towards edge AI and physical AI systems that must make real-time decisions under tight power constraints. Intel noted that TOPS (operations per second) doesn't tell the whole story—what matters more in edge AI is real-world workload performance and efficiency.

Q&A Highlights

During the earnings call Q&A, analysts from Needham & Company probed management on strategic direction:

Defense as Early Adopter: Management confirmed that military and defense has been the sector with the earliest success for Gemini 2 technology. Prior wins include SBIR awards with the DoW (Air Force Space Development Agency and U.S. Army). A SAR (Synthetic Aperture Radar) application board has been sent to an offshore defense contractor for LEO satellite evaluation.

Commercial Applications Beyond Drones: When asked about commercial potential, CEO Shu noted that the work on TTFT and Gemma 3 12B development lends itself to applications beyond drones and unmanned vehicles, specifically calling out smart cities and robotics as addressable markets.

Government Funding Pipeline: On timing of government funding, management described a continuous pipeline of SBIR submittals with multiple programs in various stages—some submitted and awaiting word, others being prepared. Beyond classic SBIRs, the company is active in BAA (Broad Agency Announcement), STRATFI, and other government funding programs. The benefit is two-fold: non-dilutive capital and increased exposure within DoD for future business development.

Balance Sheet and Cash Flow

Q3 Cash Flow:

- Beginning cash: $25.3M

- Operating cash outflow: $(7.9)M

- Investing cash outflow: $(0.3)M

- Financing cash inflow: $53.5M

- Ending cash: $70.7M

Cash consumption for operating activities includes spending for the development and commercialization of Gemini-II and Plato. At the current burn rate of approximately $8M per quarter, the company has runway extending well into FY2028.

Historical Revenue Trend

*Values retrieved from S&P Global

The company has shown consistent revenue growth since the Q2 FY2025 trough, with four consecutive quarters of year-over-year improvement.

Key Risks and Concerns

Management's forward-looking statements acknowledge several risks:

-

POC-to-Revenue Uncertainty: Proof-of-concepts and pilot programs may not translate into design wins, purchase orders, or revenue

-

Customer Concentration: Historical dependence on a limited number of customers, with mix fluctuations quarter-to-quarter

-

Development Delays: Potential delays or unanticipated costs in developing Gemini-II and Plato

-

Government Funding Timing: Availability and continuity of government funding opportunities

-

Geopolitical Risks: Military conflicts, particularly in relation to Taiwan, could impact operations

Looking Ahead

The investment narrative for GSIT has evolved from a legacy SRAM business to a company attempting a strategic pivot into edge AI inference computing. The Q3 results show the SRAM business remains healthy with 12% YoY growth, providing a revenue base while the company invests heavily in next-generation products.

Key catalysts to watch:

- Sentinel POC demonstration to government agencies (planned for later in 2026)

- Additional Gemini-II design wins in defense, robotics, or smart cities

- Plato tape out milestone (targeted early 2027)

- SRAM customer demand trends in H1 calendar 2026

- SBIR award announcements from pending submittals

Data sourced from GSI Technology Q3 FY2026 8-K filing and earnings call transcript dated January 29, 2026, and S&P Global.